E-Invoicing, Business Software, Digital Transformation

UAE E-Invoicing via PEPPOL ASP: Complete Guide to FTA Compliance & PEPPOL 5 Corners Model

Table of Contents

- 1

- 2 The Ultimate Guide to E-Invoicing in the UAE via PEPPOL ASP: Compliance, Process, and Best Practices

- 3 1. Introduction to E-Invoicing in the UAE

- 4 2. Understanding PEPPOL and the 5 Corners Model

- 5 3. Role of PEPPOL ASP in UAE E-Invoicing

- 6 4. UAE FTA/MOF E-Invoicing Requirements

- 7 5. Step-by-Step E-Invoicing Process via PEPPOL ASP

- 8 6. Benefits of Using PEPPOL ASP for E-Invoicing

- 9 7. Common Challenges and Solutions

- 10 8. How to Choose the Right PEPPOL ASP Provider

- 11 9. Future of E-Invoicing in the UAE

- 12 10. Conclusion

The Ultimate Guide to E-Invoicing in the UAE via PEPPOL ASP: Compliance, Process, and Best Practices

1. Introduction to E-Invoicing in the UAE

The United Arab Emirates (UAE) has been at the forefront of digital transformation, especially in the realm of taxation and financial compliance. The Federal Tax Authority (FTA) and Ministry of Finance (MOF) have mandated e-invoicing for all businesses, aiming to enhance transparency, reduce tax evasion, and streamline business processes.

E-invoicing is not just a regulatory requirement; it’s a strategic move towards a paperless economy. For businesses, this means adopting robust e-invoicing solutions that integrate seamlessly with global standards like PEPPOL (Pan-European Public Procurement Online).

2. Understanding PEPPOL and the 5 Corners Model

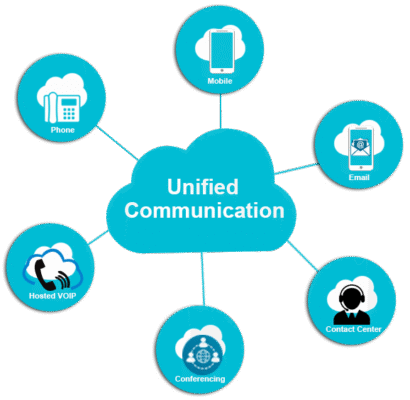

What is PEPPOL?

PEPPOL (Pan-European Public Procurement Online) is a global network that enables secure, standardized electronic document exchange between businesses and governments. It is widely adopted in the UAE and other countries for e-invoicing, e-procurement, and other B2B and B2G transactions.

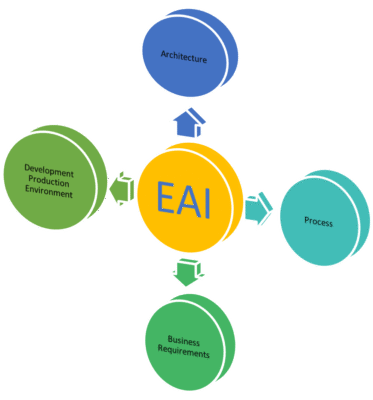

PEPPOL 5 Corners Model

The PEPPOL 5 Corners Model defines the roles and interactions in the e-invoicing ecosystem:

- Sender (Supplier): The business issuing the invoice.

- Sender’s PEPPOL ASP (Access Point Provider): The service provider that connects the sender to the PEPPOL network.

- PEPPOL Network: The global infrastructure that routes documents securely.

- Receiver’s PEPPOL ASP: The service provider that connects the receiver to the PEPPOL network.

- Receiver (Buyer): The business receiving the invoice.

This model ensures interoperability, security, and compliance across borders and industries.

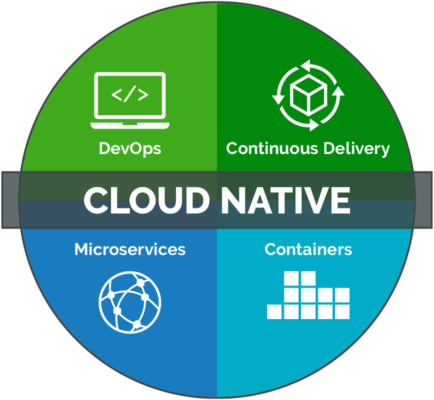

3. Role of PEPPOL ASP in UAE E-Invoicing

A PEPPOL Access Service Provider (ASP) is a certified intermediary that enables businesses to send and receive e-invoices via the PEPPOL network. In the UAE, PEPPOL ASPs play a crucial role in:

- Ensuring Compliance: Validating invoices against UAE FTA/MOF requirements.

- Secure Transmission: Encrypting and routing invoices through the PEPPOL network.

- Format Conversion: Converting invoices into PEPPOL-compliant formats (e.g., UBL, CII).

- Integration: Connecting with ERP, accounting, and VAT systems for seamless workflows.

Why Use a PEPPOL ASP?

- Automated Compliance: Reduces manual errors and ensures adherence to UAE regulations.

- Global Reach: Facilitates cross-border transactions with PEPPOL-enabled partners.

- Cost Efficiency: Lowers operational costs associated with paper invoices and manual processing.

4. UAE FTA/MOF E-Invoicing Requirements

The UAE FTA and MOF have set clear guidelines for e-invoicing:

- Mandatory Fields: Invoices must include specific details such as TRN (Tax Registration Number), invoice date, sequential number, VAT amount, and digital signature.

- Digital Signatures: Invoices must be digitally signed to ensure authenticity and integrity.

- Real-Time Reporting: Businesses must submit invoices to the FTA in real-time or near real-time.

- Archiving: Invoices must be stored securely for at least 5 years.

PINT AE (PEPPOL International Network and Transport for the UAE)

PINT AE is the UAE’s national PEPPOL authority, responsible for:

- Certifying PEPPOL ASPs operating in the UAE.

- Ensuring compliance with local and international e-invoicing standards.

- Facilitating interoperability between UAE businesses and global partners.

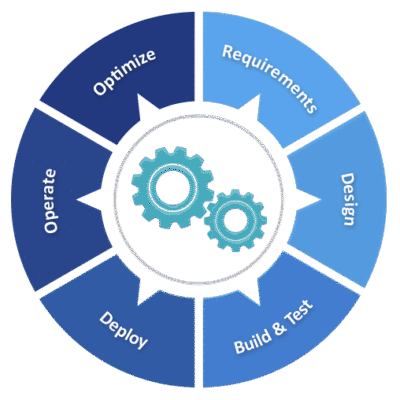

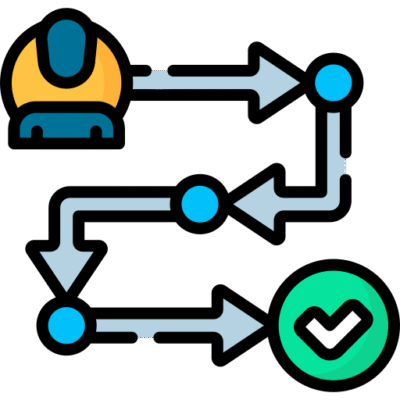

5. Step-by-Step E-Invoicing Process via PEPPOL ASP

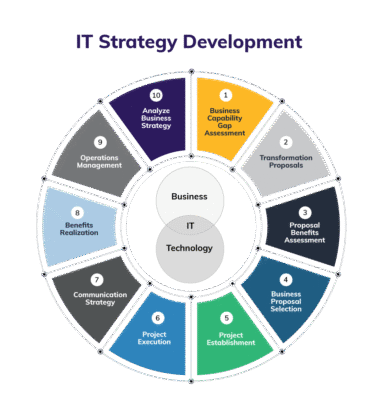

Step 1: Registration with a PEPPOL ASP

- Choose a certified PEPPOL ASP provider in the UAE.

- Register your business and obtain PEPPOL IDs for sending/receiving invoices.

Step 2: Invoice Creation

- Generate invoices in your ERP/accounting system.

- Ensure all mandatory fields (as per FTA/MOF) are included.

Step 3: Validation and Digital Signing

- The PEPPOL ASP validates the invoice for compliance.

- The invoice is digitally signed to ensure authenticity.

Step 4: Transmission via PEPPOL Network

- The ASP converts the invoice to a PEPPOL-compliant format (e.g., UBL).

- The invoice is securely transmitted through the PEPPOL network.

Step 5: Delivery to Receiver

- The receiver’s PEPPOL ASP delivers the invoice to their system.

- The receiver can view, process, and archive the invoice.

Step 6: FTA Reporting

- The PEPPOL ASP ensures the invoice is reported to the FTA as required.

6. Benefits of Using PEPPOL ASP for E-Invoicing

- Compliance Assurance: Automated checks reduce the risk of non-compliance.

- Operational Efficiency: Faster invoice processing and reduced manual work.

- Cost Savings: Lower printing, postage, and storage costs.

- Global Connectivity: Seamless transactions with international partners.

- Data Security: Encrypted transmission and secure archiving.

7. Common Challenges and Solutions

| Challenge | Solution |

|---|---|

| Integration with ERP | Choose a PEPPOL ASP with robust API/EDI capabilities. |

| Format Compatibility | Ensure your ASP supports UBL, CII, and other PEPPOL formats. |

| Real-Time Reporting | Use an ASP with automated FTA reporting features. |

| Digital Signature | Select an ASP that provides built-in digital signing. |

8. How to Choose the Right PEPPOL ASP Provider

- Certification: Ensure the provider is certified by PINT AE and PEPPOL.

- Local Expertise: Look for providers with experience in UAE FTA/MOF requirements.

- Integration: Check compatibility with your ERP/accounting software.

- Support: Opt for providers offering 24/7 support and training.

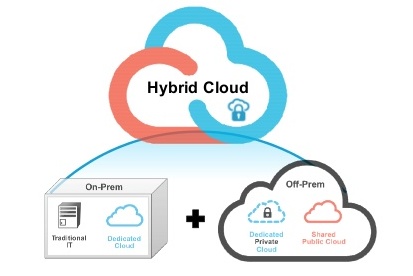

9. Future of E-Invoicing in the UAE

The UAE is rapidly moving towards a fully digital economy. Future developments may include:

- Blockchain Integration: For enhanced security and transparency.

- AI-Powered Validation: Automated checks using machine learning.

- Expanded PEPPOL Adoption: More businesses and government entities joining the network.

10. Conclusion

E-invoicing via PEPPOL ASP is not just a compliance requirement; it’s a strategic advantage for UAE businesses. By leveraging the PEPPOL 5 Corners Model and partnering with a certified ASP, companies can achieve seamless, secure, and compliant e-invoicing.

Ready to transform your invoicing process? Choose a certified PEPPOL ASP today and stay ahead in the digital economy!

Call to Action:

- Need help selecting a PEPPOL ASP? Contact our experts for a consultation.

- Want to learn more? Subscribe for updates on UAE e-invoicing regulations.

Thanks for reading! Stay curious, keep exploring.