E-Invoicing, Digital Transformation

Beyond Compliance: Our Journey to Become a PEPPOL ASP in UAE is About Business Transformation

Beyond Compliance: Why Our Journey to Become a PEPPOL Access Point in the UAE is About Business Transformation

Table of Contents

- 1 Beyond Compliance: Why Our Journey to Become a PEPPOL Access Point in the UAE is About Business Transformation

- 1.1 The Anatomy of the UAE Mandate: More Than Just “Sending Bills”

- 1.2 Deconstructing the PEPPOL 5 Corners

- 1.3 Why the UAE Needs Specialized ASPs

- 1.4 The Business Case: From Cost Center to Competitive Advantage

- 1.5 Our Roadmap to Certification

- 1.6 We Don’t Want to Just Move Data; We Want to Move Commerce

- 1.7 A Call to the Ecosystem

The sands of the UAE are shifting—not just in the dunes of the Empty Quarter, but in the ledgers and ERP systems of every company licensed to do business here. With the Ministry of Finance (MOF) and the Federal Tax Authority (FTA) solidifying the timeline for the UAE e-invoicing mandate (Phase 1), the market is currently flooded with “e-invoicing solutions.” Many claim compliance; few understand infrastructure.

As we announce our official objective to become a certified PEPPOL Access Point (ASP) in the UAE, we aren’t just announcing a new service line. We are announcing a commitment to interoperability, security, and the future of trade.

This isn’t about sending a PDF via email. It is about plugging the UAE economy directly into the global nervous system of commerce.

The Anatomy of the UAE Mandate: More Than Just “Sending Bills”

To understand why becoming an ASP is our strategic north star, we must first understand what the FTA and MOF are actually building.

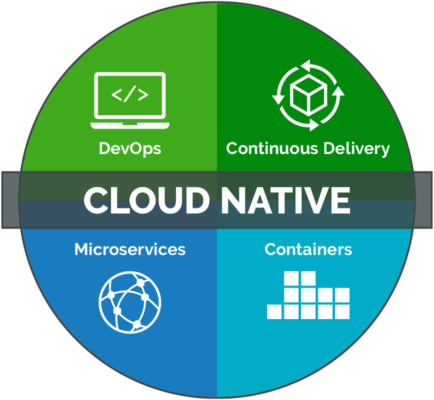

The UAE is not simply “requiring e-invoices.” They are adopting the PEPPOL (Pan-European Public Procurement On-Line) framework, localized through the UAE PINT (PEPPOL International Invoice) specification. This is a critical distinction.

When Phase 1 goes live, businesses cannot simply email a PDF and mark their task as complete. Companies will be required to exchange structured data (e-invoices and e-notes) through a decentralized, interoperable network. The only way to access this network is through a PEPPOL Access Point.

Think of the PEPPOL network as a secure postal service. You do not deliver the letter yourself; you hand it to a licensed post office (the ASP). That post office checks the address, verifies the postage (compliance), and ensures it arrives at the recipient’s post office securely.

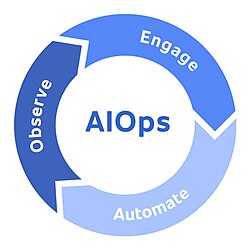

This is the PEPPOL 5 Corners Model.

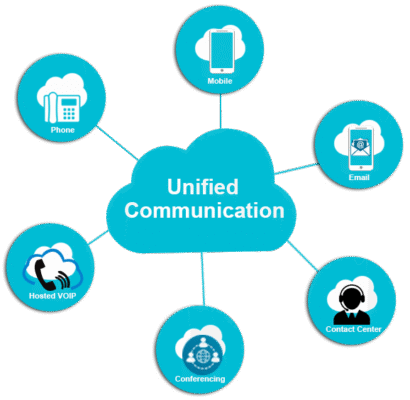

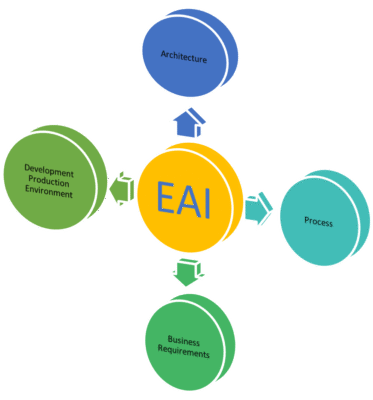

Deconstructing the PEPPOL 5 Corners

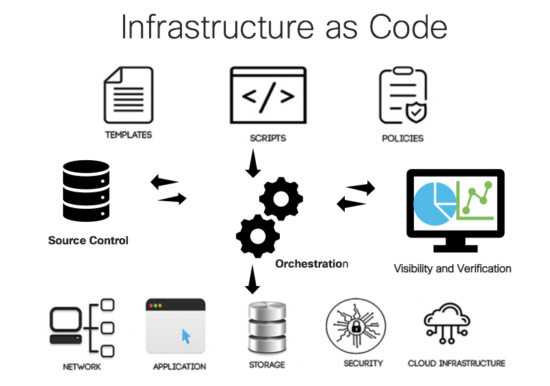

In the world of cybersecurity and data exchange, trust is transitive. The PEPPOL 5 Corners model is the architecture of this trust. For our clients, understanding this model is essential to understanding why our ASP objective matters.

Corner 1: The Sender (You): This is your company. You issue an invoice to your customer. Under the new mandate, your ERP must output a structured XML file (CIUS/EN16931 or UAE PINT).

Corner 2: The Sender’s Access Point (Us): This is where we come in. You send your invoice to our Access Point. We validate it against the strict syntax rules of the UAE PINT. If the data is missing a mandatory field required by the FTA, we bounce it back. We then wrap that invoice in a secure PEPPOL “envelope” and address it to your customer.

Corner 3: The SMP (Service Metadata Publisher): Think of this as the DNS system for invoices. Our ASP queries the network to find out where your customer is located. Are they using a different ASP? Which format do they accept? The SMP holds this “digital address book.”

Corner 4: The SML (Service Metadata Locator): This is the master switchboard, operated centrally by OpenPEPPOL. It ensures the SMP we are querying is legitimate and hasn’t been tampered with.

Corner 5: The Receiver’s Access Point: This is the ASP of your customer. They receive the secure package, de-encrypt it, transform it (if necessary), and deliver the final invoice directly into your customer’s ERP—as structured data, ready for automatic processing.

Our objective is to occupy Corners 2 and 5 with excellence.

Why the UAE Needs Specialized ASPs

There is a misconception that once you have a PEPPOL certificate, you are “compliant.” This is false. Compliance is local.

The UAE PINT AE specification is unique. While it is based on the European EN16931 standard, the FTA has introduced specific requirements tailored to the UAE tax and legal landscape. This includes specific fields for VAT treatment, specific banking identifiers, and specific allowances for free zones.

A generic European ASP might be able to pass the technical PEPPOL handshake, but can they validate the Emirati syntax? Can they differentiate between a VAT invoice required for the mainland and a VAT exemption statement required for a Designated Zone?

This is our gap. We are not building a generic ASP; we are building a UAE-native ASP. Our validation engines are being hard-coded with the logic of the FTA legislation, ensuring that if an invoice leaves our Access Point, it is compliant enough to survive a tax audit.

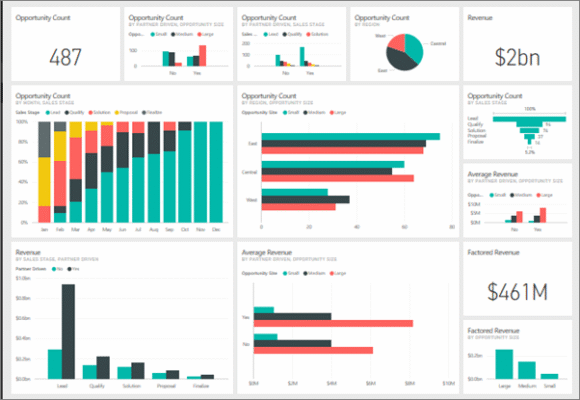

The Business Case: From Cost Center to Competitive Advantage

Many CFOs view this mandate as another compliance headache, akin to VAT registration in 2018. However, we view the ASP layer as the untapped lever for working capital optimization.

1. The Death of “Paper”: Currently, the average B2B transaction in the UAE involves an invoice sent via email (lost), followed by a reminder (ignored), followed by a physical copy mailed to a PO Box (arriving three weeks late). This creates a DSO (Days Sales Outstanding) nightmare.

By using a PEPPOL ASP, delivery is instantaneous. “Disputes” happen on Day 1, not Day 30. The clock starts ticking immediately.

2. Straight-Through Processing (STP): When you send an invoice via PEPPOL to a sophisticated buyer, their system can receive it, match it to a Purchase Order, and schedule it for payment without a human touching a keyboard. This reduces processing costs for your customer, making you a preferred supplier.

3. Trust and Security: As cyber threats rise, the risk of invoice fraud (where a supplier “changes” their bank account details via a PDF) is rampant. The PEPPOL network is encrypted end-to-end. When a buyer receives an invoice via our ASP, they know with 100% certainty it came from you, not a hacker in a basement.

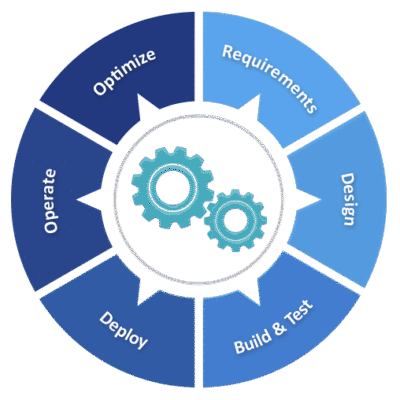

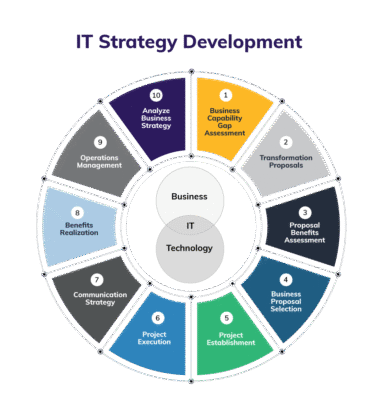

Our Roadmap to Certification

We understand that declaring an objective is easy; achieving PEPCOP accredited Access Point status is difficult.

Our roadmap currently involves:

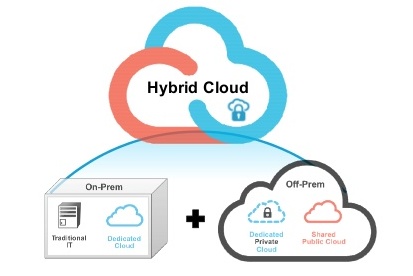

Infrastructure Development: Deploying high-availability SMP/SML clients that guarantee 99.9% uptime.

PINT AE Schema Validation: Building validation rules that go beyond the standard XSD checks to include logical business rules as defined by the FTA.

Interoperability Testing: Participating in PEPPOL’s rigorous Testbed environment to ensure we can speak seamlessly to international ASPs and local ERP gateways.

Partnership Integration: Developing plug-ins and connectors for popular ERPs (Oracle NetSuite, SAP, Microsoft Dynamics, and locally-dominant ERPs like Tally and Bizbox) to ensure the “last mile” connectivity for the sender (Corner 1) is effortless.

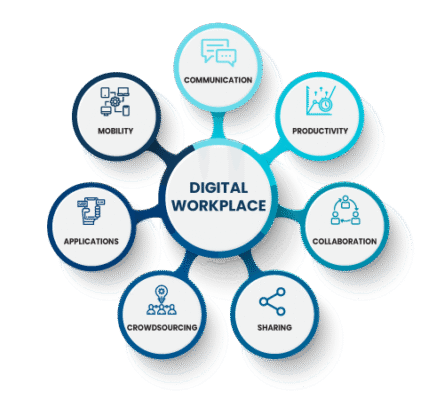

We Don’t Want to Just Move Data; We Want to Move Commerce

The UAE is building a digital economy. They are constructing the infrastructure for AI and Web3 to thrive. But AI cannot analyze your supply chain if your data is trapped in a scanned PDF sitting in a shared inbox.

By becoming a PEPPOL Access Point, we are laying the pipework for the next decade of UAE business.

For the CFO: We offer certainty in compliance and acceleration of cash flow.

For the CTO: We offer a secure, API-first infrastructure that integrates with modern tech stacks.

For the CEO: We offer a partner who understands that the future of UAE Inc. is digital.

A Call to the Ecosystem

To our competitors: The market is big enough for many ASPs. The FTA envisions a competitive landscape. We welcome the challenge and look forward to raising the bar on service quality.

To the software developers in the UAE: We are building APIs. We want to partner with you to embed e-invoicing directly into the tools businesses already use.

To the businesses of the UAE: Do not wait for the penalty notices. Phase 1 is the on-ramp to a highway. You need a vehicle that is built for speed, safety, and the local terrain.

Our journey to become a certified UAE ASP is not just about adding a badge to our website. It is about honoring the trust placed in us by the FTA and the MOF to act as a steward of the nation’s financial data.

The 5 Corners of PEPPOL are the building blocks of this new economy. We intend to be the strongest cornerstone.

Are you ready to connect?

Thanks for reading! Stay curious, keep exploring.