E-Invoicing

7 Powerful Reasons Why E-Invoicing in the UAE

7 Powerful Reasons Why E-Invoicing in the UAE Is Transforming Businesses

Table of Contents

- 1 7 Powerful Reasons Why E-Invoicing in the UAE Is Transforming Businesses

- 1.1 1. E-Invoicing in the UAE: What It Really Means

- 1.2 2. Why Is the UAE Introducing E-Invoicing? (And Why It’s Good for You)

- 1.3 3. The Real Advantages You Gain with E-Invoicing in the UAE

- 1.4 4. How Does E-Invoicing in the UAE Work? A Simple Narrative

- 1.5 5. The New Role of Compliance in UAE E-Invoicing

- 1.6 6. The Road to PEPPOL and Global Digital Trade

- 1.7 7. The Big Question: “How Do We Start?”

- 2 A Positive, Actionable Recommendation for You

- 3 Final Thoughts

As an E-Invoicing expert in the UAE working with clients across the US, UK, and GCC, I have seen firsthand how E-Invoicing in the UAE is reshaping the way businesses manage finance, compliance, and operations. And let me assure you—this is not just a government mandate. It’s a once-in-a-decade opportunity for companies to future-proof how they work.

Yet, many organizations today—especially SMEs—still feel confused, overwhelmed, or even intimidated by the idea of adopting a fully digital invoicing system.

If you’re reading this, you may be asking yourself:

- “Do I really need E-Invoicing?”

- “Is it complicated?”

- “Will I need new software?”

- “What if we make mistakes—will there be penalties?”

- “Is this another expensive compliance project?”

These questions are valid. And they’re exactly why this guide exists.

Let’s take a clear, simple, and human approach to understanding how E-Invoicing in the UAE works—and why it’s not only doable, but deeply beneficial to your business.

1. E-Invoicing in the UAE: What It Really Means

To put it simply, E-Invoicing in the UAE is the digital creation, exchange, and storage of invoices in a structured, standardized format recognized by the Federal Tax Authority (FTA).

It is NOT:

- scanning a PDF

- sending invoices via WhatsApp

- emailing a photo of a receipt

- using Excel sheets that can be edited anytime

E-Invoicing is about structured data—real invoices generated in a digital language that systems can read, validate, and share in real time.

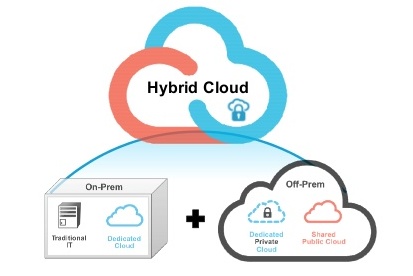

The UAE is moving toward a global-standard e-invoicing model, aligned with PEPPOL and widely accepted international tax digitalization frameworks.

This ensures transparency, accuracy, and faster business transactions across all industries.

2. Why Is the UAE Introducing E-Invoicing? (And Why It’s Good for You)

Many business owners think E-Invoicing is “just another compliance update.”

But the truth is, E-Invoicing is being introduced because:

- Fraud needs to be reduced

- Tax compliance needs to be strengthened

- Businesses need protection

- Manual errors need to disappear

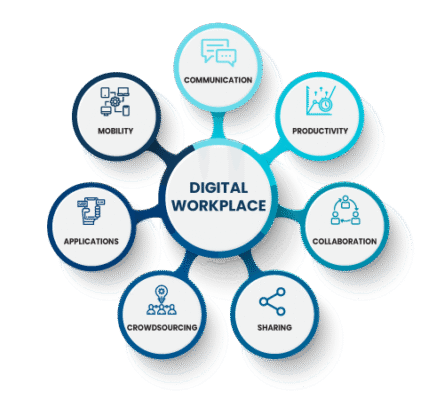

- The UAE is preparing for global trade standardization

- Digital transformation is now mandatory for competitiveness

The UAE wants its businesses to operate with global efficiency, not outdated manual processes.

Companies that adopt E-Invoicing today will run faster, smarter, and more securely than those who wait until the last minute.

3. The Real Advantages You Gain with E-Invoicing in the UAE

Let’s break down how E-Invoicing in the UAE directly improves your business.

a. Zero Manual Errors

- No more typos, mismatched amounts, or missing invoice details. Every invoice follows FTA-required fields automatically.

b. Faster Payments

- Digital invoices are delivered instantly and processed faster by customers and systems.

c. Seamless Audits

- Audits become stress-free because the FTA receives real-time, validated invoice data.

d. Reduced Fraud

- E-Invoicing drastically cuts fake invoices, duplicate entries, and tampering.

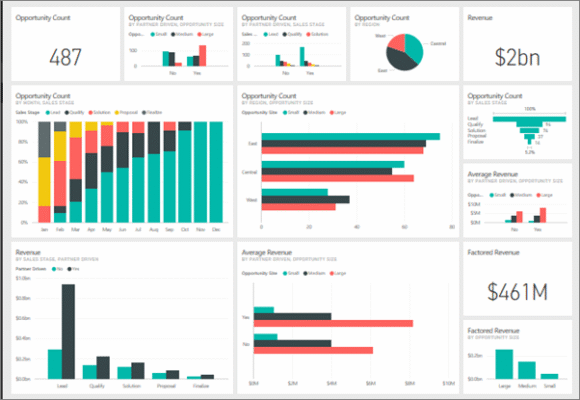

e. Real-Time Reporting

- Your finance team gets daily, hourly, or even minute-by-minute visibility.

f. Improved Cash Flow

- When invoicing is fast and accurate, payments follow the same pattern.

g. Fully Paperless Operations

- No printing. No filing cabinets. No lost documents. Just peace of mind.

4. How Does E-Invoicing in the UAE Work? A Simple Narrative

Imagine you issue an invoice to a client.

Here’s what happens under the new UAE e-invoicing system:

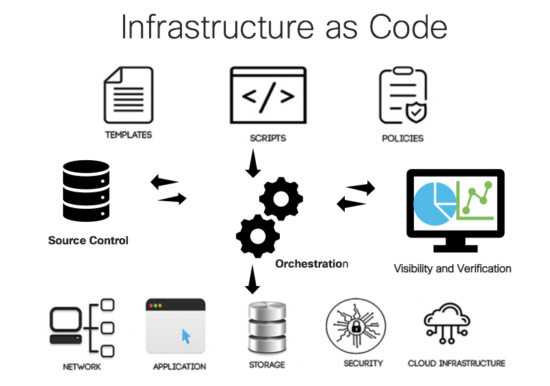

Your invoicing system creates a structured digital invoice (usually XML/UBL format).

The system validates whether all mandatory FTA fields are included.

The invoice is digitally signed to ensure authenticity.

A unique invoice number is generated for traceability.

The invoice is transmitted securely to the recipient.

The invoice is stored electronically in a compliant format.

Throughout this journey, the FTA can validate data in real time.

This means fewer disputes, faster resolutions, and a cleaner compliance record.

5. The New Role of Compliance in UAE E-Invoicing

A major misconception among business owners is:

“E-Invoicing is just an IT project.”

It’s not.

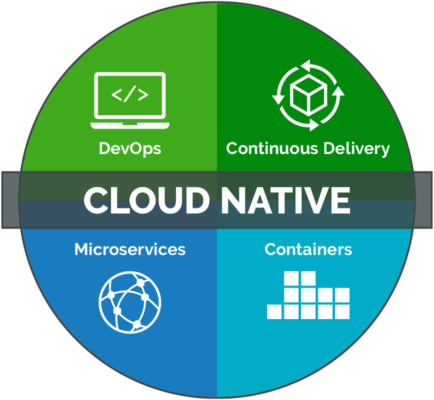

E-Invoicing is a finance + compliance transformation, supported by IT.

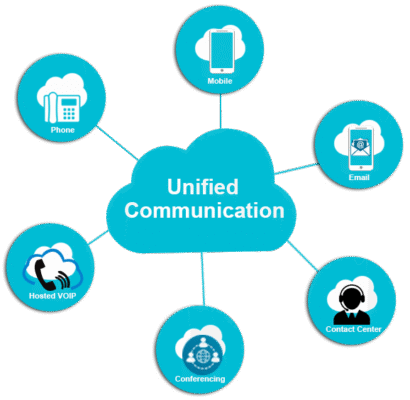

This requires collaboration among:

- Finance

- Tax teams

- Procurement

- Sales

- ERP / accounting system providers

- Your VAT consultant

- Your E-Invoicing solution provider

The companies that treat E-Invoicing as a strategic initiative—not just a rule—gain the most benefits.

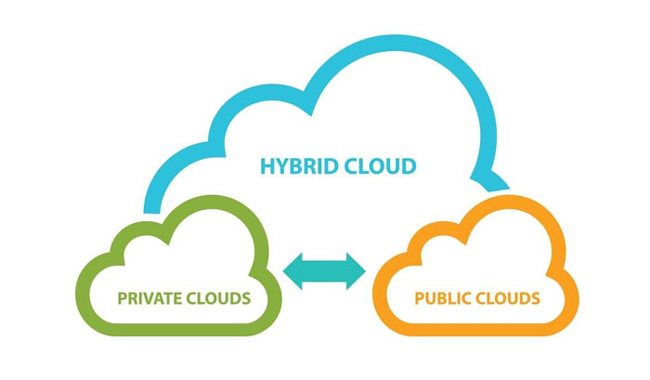

6. The Road to PEPPOL and Global Digital Trade

The UAE is moving in the same direction as:

Saudi Arabia

Europe

Singapore

Australia

New Zealand

Many GCC countries

This alignment with PEPPOL networks means companies operating internationally will eventually enjoy one global invoicing standard.

- It reduces friction.

- It reduces cost.

- It enables global business expansion.

And UAE businesses will be at the forefront.

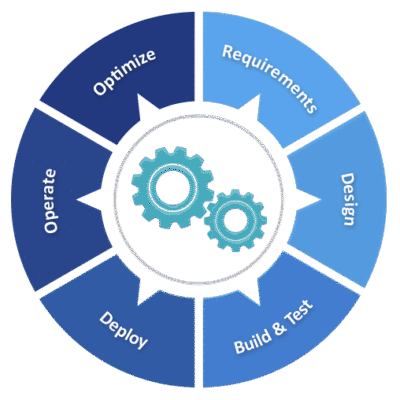

7. The Big Question: “How Do We Start?”

This is where most businesses get stuck.

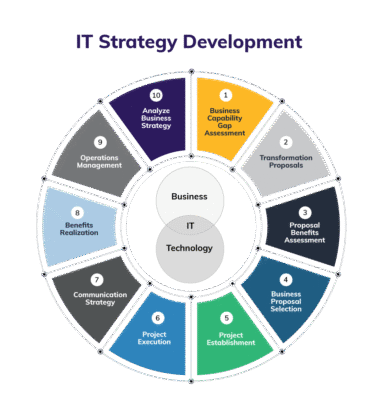

The journey to E-Invoicing in the UAE usually involves:

Step 1: Assess your current invoicing workflow

- Manual? Semi-automated? ERP-driven?

Step 2: Identify gaps vs. FTA requirements

- Do you support structured invoicing formats?

Step 3: Choose the right E-Invoicing partner

- One that understands UAE regulations, digital signatures, and system integration.

Step 4: Implement and test

- Connect your ERP or accounting system.

- Run invoice validation tests.

- Ensure everything aligns with FTA requirements.

Step 5: Train your teams

- Finance and operations teams must understand the new workflow.

Step 6: Go live

- Your system is ready to transmit and receive validated e-invoices.

A Positive, Actionable Recommendation for You

If your business wants to avoid last-minute compliance pressure, unnecessary penalties, or costly rework, start preparing for E-Invoicing in the UAE now.

Here is what I strongly recommend:

✔ Begin with an E-Invoicing Readiness Assessment

Understand your current systems and compliance gaps.

✔ Choose a solution designed specifically for the UAE regulatory environment

Generic global software may not fully comply with FTA requirements.

✔ Prepare your teams early

A smooth transition relies on awareness, training, and workflow clarity.

✔ Think beyond compliance

E-Invoicing is a catalyst for digital transformation—not a burden.

✔ Leverage automation wherever possible

It reduces human error, accelerates cash flow, and makes invoice management easier.

Final Thoughts

The shift to E-Invoicing in the UAE is not just a regulatory update—it’s a strategic leap toward smarter, more efficient, and more transparent business operations.

Companies that embrace this change early will enjoy:

seamless compliance

faster payments

stronger financial health

improved visibility

and a future-proof digital ecosystem

As someone who has guided hundreds of businesses across the UAE, I can confidently say this:

You won’t just survive the transition to E-Invoicing—you’ll thrive because of it.

If you need help understanding the system, preparing for compliance, or selecting the right technology, I’m here to guide you every step of the way.

#EInvoicingUAE #DigitalTransformationUAE #UAEBusiness #TaxCompliance #EInvoice #FTAUAE #DigitalFinance #PaperlessUAE

Thanks for reading! Stay curious, keep exploring.