E-Invoicing

7 Powerful Reasons Why a Global E-Invoicing Solution

7 Powerful Reasons Why a Global E-Invoicing Solution Will Transform Your Business

Table of Contents

- 1 7 Powerful Reasons Why a Global E-Invoicing Solution Will Transform Your Business

- 2 The 7 Transformational Benefits of a Global E-Invoicing Solution

- 2.0.1 1. Compliance Without Stress—No Matter the Country

- 2.0.2 2. Cost-Efficient Operations and Zero Manual Errors

- 2.0.3 3. Smooth Interoperability With All Your Systems

- 2.0.4 4. Faster Payments and Improved Cash Flow

- 2.0.5 5. Real-Time Insights for Strategic Decision-Making

- 2.0.6 6. Stronger Security and Fraud Prevention

- 2.0.7 7. Future-Proof Digital Transformation

- 2.1 The Hidden Pain Businesses Don’t Talk About

- 2.2 An Actionable, Positive Recommendation

As the Chief Executive Officer of a multinational IT consultancy operating across the US, UK, and the UAE, I’ve witnessed firsthand the growing urgency for businesses to adopt a Global E-invoicing solution. Whether you operate in a single country or across multiple regions, your financial processes face enormous pressure—from government mandates and tax regulations to cross-border compliance, supplier demands, and the rising cost of manual operations.

And if you’re reading this, chances are you already feel some of that pressure.

Maybe your inbox is overflowing with vendor queries.

Maybe your finance team spends long nights reconciling invoices.

Maybe you are entering new markets and fear non-compliance penalties.

Or maybe you’re simply tired of outdated, inefficient, and error-prone invoicing systems.

If any of that resonates with you, you’re exactly the reader I had in mind while writing this.

Let’s explore, in a relatable and jargon-free way, how a Global E-invoicing solution can change your business at its core.

A New Reality: Why Companies Everywhere Are Adopting E-Invoicing

Corporate leaders around the world—CEOs, CFOs, finance directors, operations managers—share a common frustration:

Traditional invoicing systems are not built for modern business.

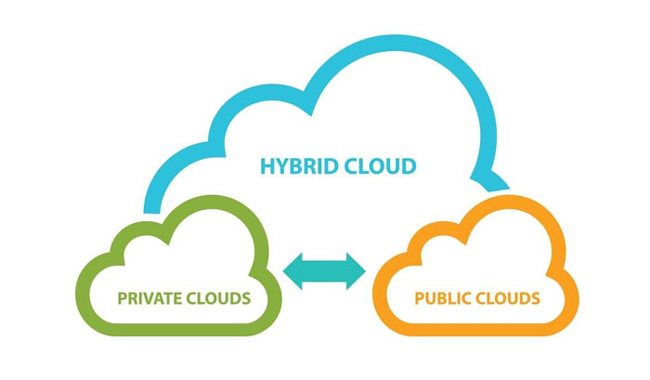

Your business now interacts with global suppliers, international tax systems, cross-border transactions, and digitally transforming governments. Many countries no longer “suggest” e-invoicing; they require it.

This rapid shift leaves many business owners with questions such as:

“How do I know which e-invoicing model is right for my company?”

“What if my ERP or accounting system is too old?”

“How do I avoid compliance issues when regulations change every month?”

“How can I make this transition without disrupting operations?”

These concerns are valid—and common. But the good news is that a modern Global E-invoicing solution makes the transition smoother than you expect. Let me walk you through how.

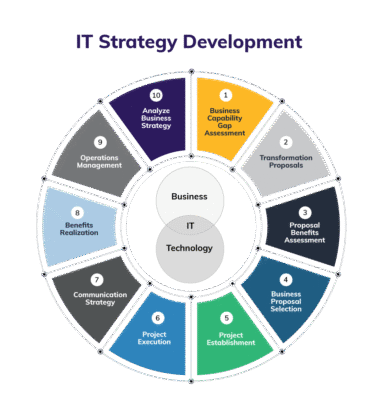

The 7 Transformational Benefits of a Global E-Invoicing Solution

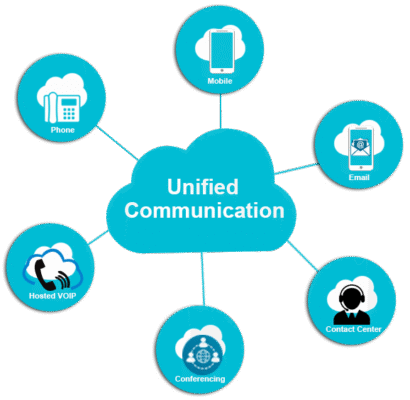

1. Compliance Without Stress—No Matter the Country

Every region has its own rules:

Europe uses structured e-invoice formats via PEPPOL and country-specific mandates.

Middle East countries like UAE, Saudi Arabia, and Egypt enforce tax clearance and real-time reporting.

APAC countries like Singapore, Malaysia, Japan, and Australia have different government networks and QR requirements.

LATAM countries enforce some of the strictest clearance-based e-invoicing models.

Trying to manually keep track of this is a recipe for compliance failure.

A Global E-invoicing solution automatically adapts to each country’s rules—format, data fields, validations, digital certificates, tax rules, and submission workflows—without requiring your internal team to constantly monitor regulatory updates.

Your operations continue.

Your invoices stay accurate.

Your compliance remains intact.

2. Cost-Efficient Operations and Zero Manual Errors

Let’s face it—the cost of manual invoicing is massive:

Human errors

Duplicate invoices

Delayed approvals

Miscommunication

Lost documents

Hours wasted on data entry

A centralized Global E-invoicing solution automates the entire workflow:

Invoice creation

Data validation

Delivery to government portals

Approval routing

Archiving

Reconciliation

This eliminates unnecessary costs and gives your finance team time back to work on strategy instead of firefighting.

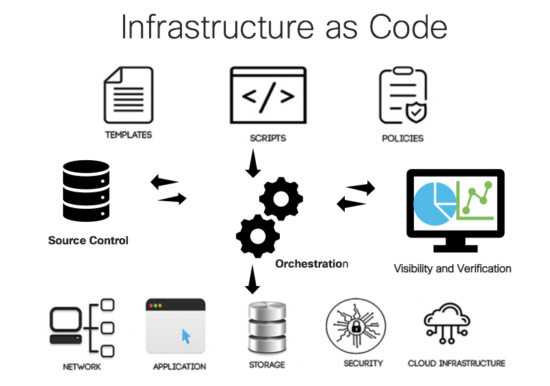

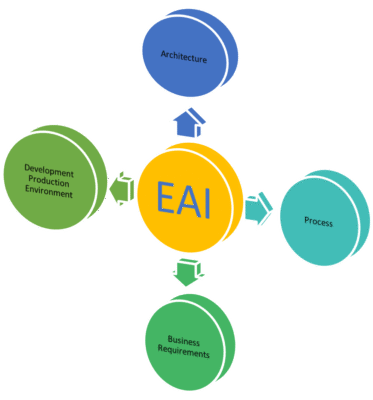

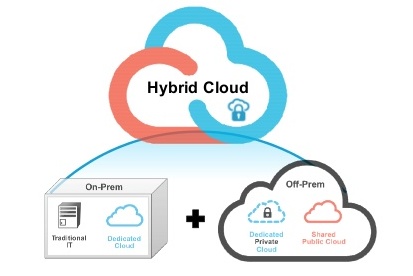

3. Smooth Interoperability With All Your Systems

Companies often worry:

“But our ERP is outdated.”

“We use multiple systems.”

“My suppliers use different software.”

A Global E-invoicing solution integrates seamlessly with major platforms—including SAP, Oracle, NetSuite, Microsoft Dynamics, QuickBooks, Odoo, Zoho, and even custom legacy systems.

It doesn’t matter how many systems you use.

It doesn’t matter what your partners use.

The solution acts as the bridge—unifying your financial data and keeping everything compliant and connected.

4. Faster Payments and Improved Cash Flow

When you automate and streamline your invoicing:

Invoices reach customers faster.

Errors are reduced dramatically.

Approval cycles shorten.

Tax compliance issues disappear.

Payment delays decrease.

In short:

You get paid faster.

A Global E-invoicing solution also gives you visibility into every invoice status—from creation to delivery to recognition—so you always know where your money is and when it’s coming.

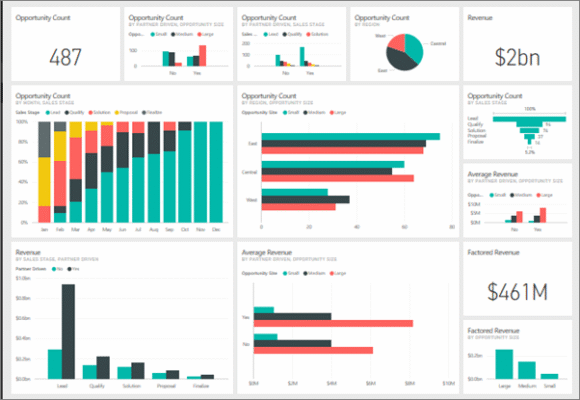

5. Real-Time Insights for Strategic Decision-Making

Successful CEOs don’t make decisions based on guesses—they rely on real numbers.

A modern Global E-invoicing solution provides clear, actionable insights:

Spend analytics

Vendor performance

Payment timelines

Cash-flow forecasting

Tax exposure

Compliance heatmaps

Instead of reading messy spreadsheets or chasing after reports, you get real-time dashboards that guide smarter decisions.

6. Stronger Security and Fraud Prevention

Invoice fraud is one of the most common corporate threats today.

A Global E-invoicing solution protects your business with:

Encrypted document exchange

Government-validated submissions

Digital signatures

Audit trails

Access control

Real-time tracking

You gain peace of mind knowing your financial ecosystem is secure, validated, and monitored end-to-end.

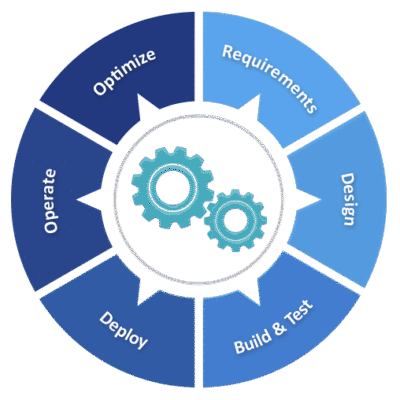

7. Future-Proof Digital Transformation

E-invoicing isn’t just a compliance requirement—it’s a transformation driver.

By adopting a Global E-invoicing solution, you prepare your company for:

Rapid international growth

Scalability

New government regulations

Cross-border trade

ERP modernization

AI-powered automation

It’s not simply about keeping up.

It’s about stepping ahead.

The Hidden Pain Businesses Don’t Talk About

Many CEOs privately share the same fears:

“What if my team can’t adapt?”

“What if this disrupts our operations?”

“Are we too late to start?”

“Will this be expensive?”

Let me ease your mind with reassurance:

You are not too late. And you are not alone.

Every major company you admire has gone through this transition.

Every successful CFO, CEO, and Finance Director has had the same questions.

The key difference is that they took the first step.

Your business can too.

An Actionable, Positive Recommendation

If you’re considering implementing a Global E-invoicing solution, here is my strongest advice as a CEO:

Start with a scalable, compliance-ready, globally connected platform—and expand at your own pace.

Don’t jump into a complex implementation.

Don’t try to transform everything in one go.

Instead:

Begin with a simple assessment of your current invoicing flows.

Identify your compliance-critical regions.

Integrate your main ERP or accounting system first.

Expand to suppliers and partners once your core workflow is stable.

Let your Global E-invoicing solution grow with your company—not ahead of it.

This approach reduces risk, saves cost, and builds confidence across your organization.

You deserve a financial ecosystem that is compliant, intelligent, fully connected, and ready for global expansion.

And your business is absolutely capable of achieving it.

#GlobalEInvoicingSolution #EInvoicing #DigitalCompliance #FinanceTransformation #CFOInsights #BusinessEfficiency

Thanks for reading! Stay curious, keep exploring.