E-Invoicing

3 Powerful Reasons Why a Peppol ASP Accreditation

3 Powerful Reasons Why a Peppol ASP Accreditation is Your Key to Seamless UAE e-Invoicing

Table of Contents

Let’s be honest. As a business leader, the words “new government mandate” can sometimes send a slight shiver down your spine. I get it. My role as a CFO isn’t just about numbers; it’s about steering the ship through changing tides, ensuring we’re compliant, efficient, and always ahead of the curve. So, when the UAE Ministry of Finance announced its push for e-invoicing, I knew this wasn’t just another regulation—it was a fundamental shift.

And at the heart of this exciting shift is a term you’ve probably been hearing a lot: Peppol ASP accreditation.

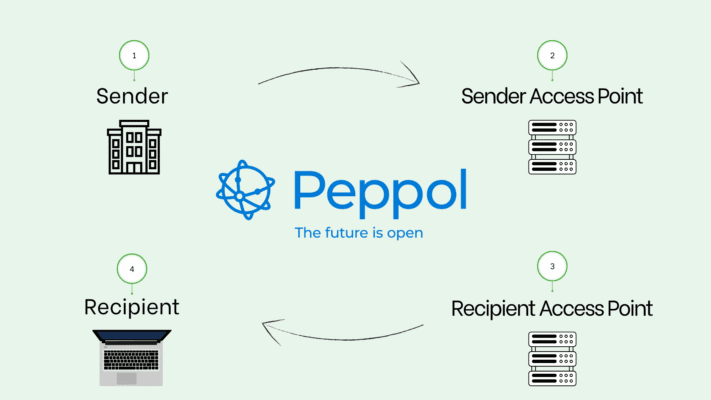

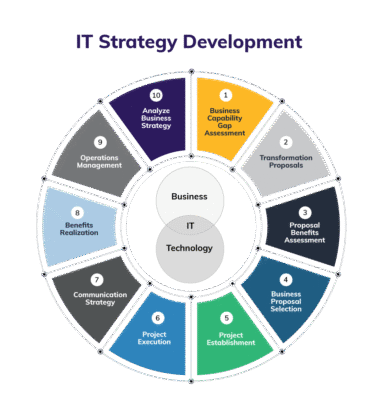

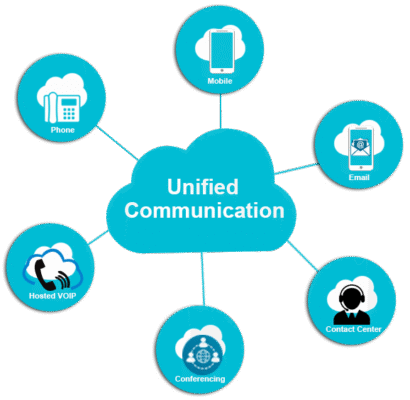

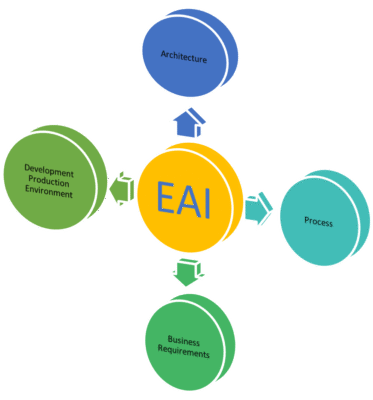

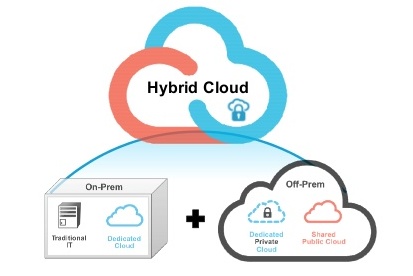

If your eyes are starting to glaze over, please stay with me. I’m going to tell you a quick story. Imagine trying to send an email from a Gmail account to a Yahoo account, but it just bounces back. Frustrating, right? That’s what business communication was like before universal standards. The Peppol network is the magical, universal postman for your invoices, ensuring they get where they need to go, instantly and flawlessly. An Accredited Peppol Service Provider (ASP) is your trusted partner who has been officially certified to use this magical postman.

Think of it this way: the UAE Ministry of Finance has built a new, super-efficient, nationwide highway system for all financial documents—the Peppol network. You can’t just drive any vehicle on it; you need a certified, road-worthy car. A Peppol ASP is that certified, high-performance vehicle for your business.

This isn’t just bureaucratic red tape. This is the UAE building the financial infrastructure of the future, and it presents an incredible opportunity for your business. Here’s why choosing a Peppol ASP accredited partner is the single most important decision you’ll make for your e-invoicing journey.

1. Your Golden Ticket to Trust and Compliance (No More Guesswork!)

When the Ministry of Finance accredits a service provider, they are essentially giving them a seal of approval. This seal screams one thing: TRUST.

I know the pain of wondering, “Is this software really compliant? Will it pass an audit? Are we setting ourselves up for future headaches?” It’s a nagging doubt that can keep any finance professional up at night. By partnering with a Peppol ASP, you are effectively outsourcing that worry. The Ministry has already done the heavy lifting for you. They’ve rigorously tested the provider’s technology, security, and adherence to the global Peppol standards and local UAE requirements.

This means you can sleep soundly, knowing your e-invoicing process is built on a rock-solid, government-approved foundation. You’re not just buying software; you’re buying peace of mind. This accreditation is your assurance that you are on the right side of the law, today and as regulations evolve tomorrow. It removes the fear of the unknown and replaces it with the confidence of certified compliance.

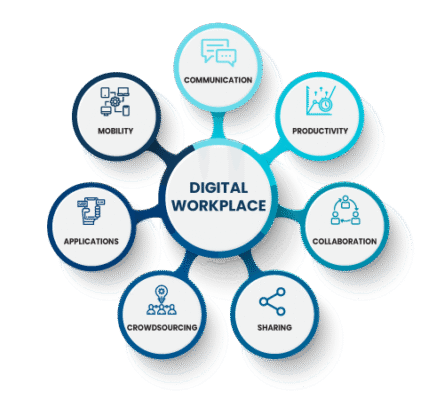

2. Unlock a World of Seamless Connectivity (Goodbye, Silos!)

Before this, connecting with all your business partners—especially those on different accounting or ERP systems—was like trying to fit a square peg into a round hole. It was clunky, required manual data entry, and was ripe for errors. This fragmentation creates what I call “digital silos,” where information gets trapped.

The beauty of the Peppol network is that it smashes these silos to pieces. It’s a universal language for business documents. When you use a Peppol ASP, you are not just connecting to one customer or one supplier. You are plugging into an entire ecosystem.

Imagine this: You send an invoice to a government entity, a large multinational corporation, and a small local supplier. With a Peppol ASP, it’s the same simple, seamless process for all of them. The invoice flies through the network and lands directly in their system, ready for processing. This interoperability is a game-changer. It eliminates re-keying errors, speeds up payment cycles dramatically, and slashes administrative costs. It’s the difference between sending a letter via horseback and sending an instant message. The efficiency gains are not just incremental; they are transformational.

3. Future-Proof Your Finance Function (Hello, Innovation!)

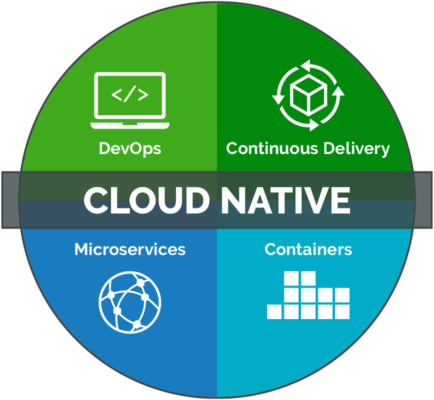

The move to accredited e-invoicing is not the end of the journey; it’s the beginning. The UAE’s vision, as seen with similar initiatives in Saudi Arabia (ZATCA), is a fully digitized, transparent, and data-driven economy. By choosing a Peppol ASP today, you are not just solving for today’s e-invoicing requirement. You are positioning your business at the forefront of this digital revolution.

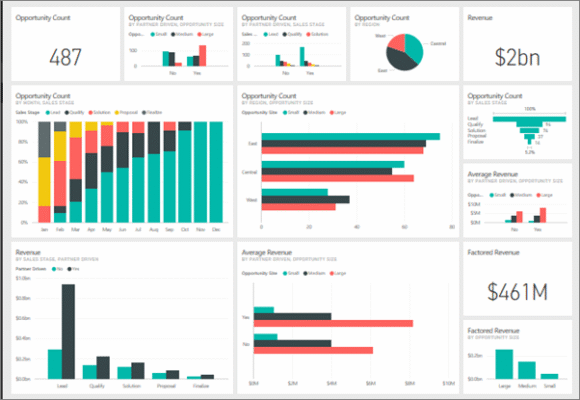

Think of the data! With all your invoicing data flowing through a streamlined, digital system, you gain unprecedented visibility into your cash flow, spending patterns, and supplier relationships. This is the kind of clean, real-time data that empowers a CFO to make strategic decisions, not just administrative ones.

Your accredited service provider is your partner in this evolution. They are invested in the Peppol ecosystem and will be the first to offer new services as they become available—be it e-orders, e-catalogues, or advanced analytics. You are building a foundation that is scalable, secure, and ready for whatever the future holds.

Your Positive and Actionable Path Forward

The transition to e-invoicing might feel like a mountain to climb, but with the right guide, it’s an exhilarating ascent with a breathtaking view from the top. The UAE government has given us a clear map and a list of certified guides—the accredited Peppol Service Providers.

My strong, positive, and compelling recommendation to you is this: Don’t see this as a compliance check-box. See it as a strategic upgrade.

Here is your simple, actionable plan:

Embrace the Change: Shift your mindset from seeing this as a cost to viewing it as a strategic investment in efficiency, security, and growth.

Choose Wisely: When selecting your e-invoicing solution partner, make Peppol ASP accreditation by the UAE Ministry of Finance your non-negotiable, number one criteria. This is your primary filter.

Start the Conversation: Reach out to one of these accredited providers today. Ask them to show you how simple the transition can be and how quickly you will start to see the benefits.

The future of finance in the UAE is digital, interconnected, and incredibly bright. By partnering with a Peppol ASP, you are not just keeping up; you are leaping ahead. You are ensuring your business operates with the efficiency, security, and innovation that defines the modern UAE economy.

Let’s build that future, together.

#PeppolASP #UAEeInvoicing #MoFAccreditation #DigitalTransformation #FinanceInnovation #CFOInsights #ZATCA #EInvoicingUAE

Thanks for reading! Stay curious, keep exploring.